Vic’s Statehouse Notes #355

Dear Friends,

The Senate budget proposal was announced on April 8th.

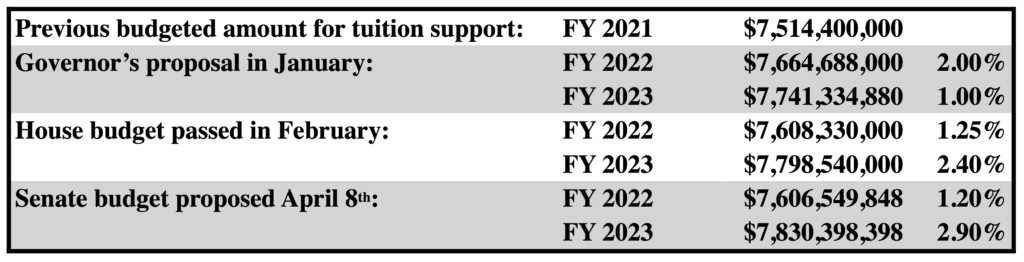

The Senate budget put more money into the K-12 budget than did the House plan in the second year of the budget. In the second year (FY 2023), the House increase was 2.4% and the Senate increase was 2.9%.

The House and Senate increases for the first year of the budget (FY 2022) were similar: 1.25% in the House version and 1.2% in the Senate version.

Now the House and Senate leaders will negotiate the final budget. The revenue forecast scheduled to be released on April 15th could change the final budget agreement.

Your messages to legislators to better support public education could also change the final budget. Keep writing!

For public education, the provisions for voucher expansion and ESA’s are better in the Senate budget. Speaker of the House Huston said “we will be negotiating aggressively around those provisions” to help senators “see the light” on voucher expansion (Associate Press, Tom Davies, 4-8-21). Both House and Senate members must hear your deep opposition to voucher expansion and Education Scholarship Accounts in the next week as the negotiations proceed.

How ironic it is that Speaker Huston can get so enthused about expanding vouchers when the 2-year effort to raise teacher pay has been ignored in this session and the Senate budget leaves a $2 billion surplus at the end of the biennium. Let your voice be heard!

Compare with the Previous Budget

Here are the numbers to compare with the previous budget passed in 2019:

The Senate released a power point with the new budget that says FY 2023 is a 4.2% increase. That number turns out to be the percent increase for two years, from FY 2021 to FY 2023. It is rare for a 2-year percentage increase to be cited. The FY 2023 increase from FY 2022 is 2.9%.

Next Compare Current Proposals with Seven Previous Budgets

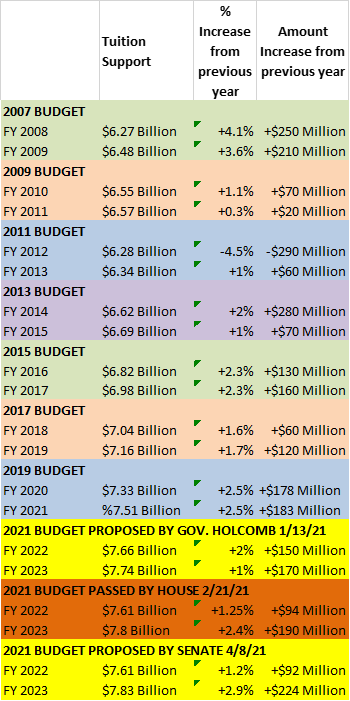

Track the comparisons for the past seven budgets with the Governor’s January budget proposal, the House’s February budget proposal and the Senate’s April budget proposal.

INDIANA SCHOOL FUNDING INCREASES FOR THE PAST SEVEN BUDGETS FOR COMPARISON WITH GOV. HOLCOMB’S BUDGET {JANUARY), THE HOUSE BUDGET (FEBRUARY) AND THE SENATE BUDGET (APRIL)

Source: The summary cover page from the General Assembly’s School Formulas for each budget and House Bill 1001 (the budget bill) in each year.

Prepared by Dr. Vic Smith, 4-9-21

When the school funding formulas are passed every two years by the General Assembly, legislators see the bottom line percentage increases on a summary page. Figures that have appeared on this summary are listed below for the last seven budgets that I have personally observed as they were approved by the legislature.

Tuition support and dollar increases have been rounded to the nearest 10 million dollars.

Total funding and percentage increases were taken directly from HB 1001 (the budget) and the School Funding Formula summary page. Sometimes in the first year of two budget years, the previous budget amount was not fully spent and the adjusted lowered base was used by the General Assembly to calculate the percentage increase. In this historical listing, the amount passed in the previous budget is used as the baseline to calculate increases and percentage changes.

*As presented by the Governor.

**The House plan for voucher expansion and ESA’s would cost $144 million taken from the $378 million increase in tuition support (38%) according to the non-partisan Legislative Services Agency.

*** The Senate plan for voucher expansion and ESA’s would cost $54 million taken from the $408 million increase in tuition support (13%) according to the Legislative Services Agency.

Education Scholarship Accounts: Milton Friedman’s Plan for Ending Public Education

The new attack on public education through Education Scholarship Accounts (ESA’s) was mitigated in the Senate budget compared to the House budget, but ESA’s are still in the Senate plan. Write your legislators to object — again!

- ESA’s would be started in the second year of the budget (FY 2023) and would be capped at $3 million for parents to claim for their home schools, compared to $19 million estimated for the House ESA plan.

- The amount claimed would be equal to what the student would qualify for under tuition support that is currently sent to the school district, about $7000 plus the Special Education grant which could range from $500 to $10,575.

- Only special education students would be eligible. Under the House budget, students of active military and foster students are also eligible.

- Upper income families would be eligible with income up to $109,000 for a family of four.

While the Senate endorsed a smaller program, this is a flawed plan and dangerous plan. ESA’s, paid for by your tax money, would go to parents

- with no accountability, no standards and no required state tests.

- with no criminal background checks to protect the program from convicted child abusers.

- with no protection from extremists running a home school teaching disloyalty to the U.S. Constitution or teaching racism.

- with no voice from taxpayers who are footing the bill about home school policies.

Protections to fix these problems could be put in place with amendments, but no such amendments have been given consideration.

This is obviously a dangerous idea which threatens whether children growing up in Indiana will learn the principles and ideals of a democratic society. Let legislators know of your deep opposition.

Voucher Expansion: More money for upper income private school parents

House members led by Speaker Huston are praising the expansion of vouchers. The Senate budget dialed back the voucher expansion in the House budget, but still included a $51 million expansion.

- The 50% voucher and the 70% voucher are to be eliminated in favor of giving every voucher student a 90% voucher, which only lower income families currently receive. Under this plan, there is no difference between lower income and upper income voucher amounts.

- Families making up to $109,000 for a family four could get a voucher. The current cap is $96,000.

Tax Credit Scholarships: Donations to private school scholarships for a 50% tax credit

Starting out in 2009 as a $2.5 million annual cost to taxpayers, the SGO Tax Credit program has been favored by the Senate budget for $3 million more over two years. A $1 million increase to $17.5 million would come in the first year, and the second year of the budget would increase to $18.5 million.

The Big Picture

The enormity of damage the ESA plan will do to public education has been glossed over in the media and needs to be brought to the attention of every legislator during the final budget negotiations. Will you send messages to your legislators?

It doesn’t matter if you send messages to the House or the Senate leaders. They all need to hear your preference for the Senate plan compared to the House and your objections to the way this session has been steered to undercut public education.

In a year when the pandemic has demoralized the public education community, the Republican leadership has decided not to support public education to get through the crisis, but to attack it to speed privatization through the new concept of funding independent home schools with Education Scholarship Accounts (ESA’s) as well as through expanding vouchers. To the extent parents follow this incentive to take money directly from taxpayers for home-schooling their special education student, special education programs which are strongly supported by many parents will lose funding and strength.

Those driving these changes during the pandemic know that if public schools and public school teachers are demoralized, it will be easier for private schools to succeed, attracting more parents and more teachers.

This is exactly how Milton Friedman proposed the unraveling of public education in America.

Send messages to your legislators or any legislators that ESA’s are not only bad policy but would further demoralize the teachers and administrators of Indiana.

Grassroots support of public education makes all the difference. Thank you for your active support of public schools in Indiana!

Best wishes,

Vic Smith vic790@aol.com